do you have to pay inheritance tax in arkansas

However the Internal Revenue Service IRS can impose a tax on all the assets a deceased person leaves behind them known as their estate. The state where you live is irrelevant.

Arkansas Estate Tax Everything You Need To Know Smartasset

Inheritance tax payments are due upon the death of the decedent and become delinquent nine months after the individuals death.

. The laws regarding inheritance tax do not depend on where you as the heir. This means that a beneficiary inheriting property in Arkansas will not owe any inheritance tax. Arkansas does not have an inheritance tax.

How much is US inheritance tax. An heirs inheritance will be subject to a state inheritance tax only if two conditions are met. Generally when you inherit money it is tax-free to you as a beneficiary.

This is because any income received by a deceased person. How long do you have to pay. The deceased person lived in a state that collects a state inheritance tax or owned bequeathed property located there and the heir is in a class that isnt exempt from paying the tax.

Strictly speaking it is 0. Arkansas does not collect inheritance tax. However residents of Arkansas will have to pay inheritance tax if they inherit property from states that collect the tax.

In those states that do impose an inheritance tax spouses may inherit without the estate incurring an inheritance tax. The fact that Arkansas has neither an inheritance tax nor an estate tax does not mean all Arkansans are exempt when it comes to tax consequences as part of an estate plan. Below well go through several key rules to help you determine when you might have to pay taxes on an inheritance.

There is no federal inheritance tax but there is a federal estate tax. Do you have to pay taxes on inheritance. The current tax rate is between 35 percent and 55 percent for any amount above the exemption depending on how much you have so this can amount to a significant loss of assets for your family or other heirs.

The inheritance laws of another state may apply to you if you inherit money or property from a person that lives in a state that has an inheritance tax. Arkansas does not impose an inheritance tax. Which states have no inheritance or estate tax.

There is no federal inheritance tax The first rule is. Do you have to pay inheritance tax in Arkansas. However like any state Arkansas has its own rules and laws surrounding inheritance including what happens if the decedent dies without a valid will.

That being said the states with no state estate tax as of January 1 2020 are. You might inherit 100000 but you would pay an inheritance tax on just 50000 if the state only imposes the tax on inheritances over 50000. This does not mean however that Arkansas residents will never have to pay an inheritance tax.

At the federal level there is no tax on. Other inheritors such as children and domestic partners may be entitled to a different exemption status and tax rate depending on which state they live in. Whether or not you have to pay inheritance tax depends on the state you live in the size of the inheritance and your relation to the deceased.

Do beneficiaries of an estate pay tax. Arkansas does not have a state inheritance or estate tax. State rules usually include thresholds of valueinheritances that fall below these exemption amounts arent subject to the tax.

As you can see North Carolina is not on the list of states that collect an inheritance tax meaning you do not need to worry about your inheritance being taxed by the state. In 2021 federal estate tax generally applies to assets over 117 million. The amount exempted from federal estate taxes is 1119 million for 2019 but if you do not plan properly then your family or other heirs could end up getting far less of your assets than you.

There is no federal inheritance taxthat is a tax on the sum of assets an individual receives from a deceased person. Luckily capital gains taxes for an inherited property are always assessed as though it were a long-term gain even if you own the property for less than a year. For tax purposes an inheritance isnt normally considered taxable income unless its generating frequent returns such as a rental property or an asset that provides interest or dividend payments.

States such as Iowa New Jersey Kentucky and Pennsylvania collect inheritance tax. This article covers probate how to successfully create a valid will in Arkansas. Sexton Bailey Attorneys PA - SEXTON BAILEY ATTORNEYS PA.

Do you have to pay estate tax in Arkansas. What percentage is inheritance tax in Arkansas. If inheritance tax is paid within three months of the decedents death a 5 percent discount is allowed.

Contact Us If you have additional questions about the North Carolina inheritance tax contact an experienced Greensboro probate attorney at The Law Offices of Cheryl David. To that end long-term capital gains are taxed between 0 to 20 depending on your income and marital status making the tax basis more adjustable.

Arkansas Last Will And Testament Template Download Printable Pdf Templateroller

Historical Arkansas Tax Policy Information Ballotpedia

Complete Guide To Probate In Arkansas

Arkansas Health Legal And End Of Life Resources Everplans

Arkansas Estate Tax Everything You Need To Know Smartasset

File Bierstadt Map Gif Albert Bierstadt South Dakota Old Maps

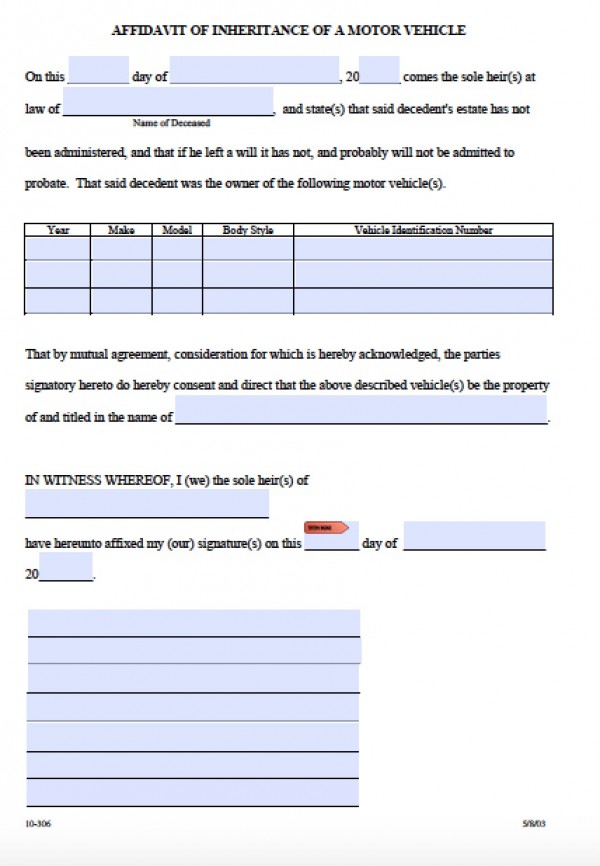

Free Arkansas Affidavit Of Inheritance Motor Vehicle Form Pdf Word

Arkansas Inheritance Laws What You Should Know Smartasset

Can The State Of Arkansas Tax My Inheritance Milligan Law Offices

Arkansas Affidavit Of Inheritance Of A Motor Vehicle Form Pdfsimpli

Arkansas State Tax Refund Ar State Income Tax Brackets Taxact

Individual Income Tax Arkansas Department Of Finance And

Arkansas State 2022 Taxes Forbes Advisor

Arkansas Affidavit Of Financial Means Download Fillable Pdf Templateroller

Arkansas Gift Deed Form Download Printable Pdf Templateroller

Arkansas Estate Tax Everything You Need To Know Smartasset

Is There An Inheritance Tax In Arkansas

Complete Guide To Probate In Arkansas

States Where Residents Are Most Satisfied Estate Tax Inheritance Tax Nightlife Travel